November 2025 Crypto Cycle Outlook: Mid-Cycle, Maximum Opportunity

- C Dog Lara

- Nov 2, 2025

- 1 min read

Summary: This Is the Middle Game

Crypto is not peaking. It’s positioning.

We are in Phase 2 of the cycle: breakouts are real, but euphoric flow has not begun. Bitcoin is the base layer of confidence. Ethereum is still under-rotated. Altcoins are behaving like they should — hesitant, selective, and structure-first.

This is when smart capital accumulates. It’s also when the best educators build conviction.

🧭 KaiRise Cycle Map (2022–2026)

Phase | Date Range | Current Status | Behavior |

① Accumulation | 2022 – Q1 2024 | Complete | Low volume, whale entries |

② Expansion | Q2 2024 – Now | Active, BTC leading | Steady trend, low retail |

③ Euphoria | Mid-2026? | Not yet | Volatility, high alt rotation |

④ Distribution | TBD | N/A | Blow-off + exit |

📊 Key Cycle Metrics (November)

Metric | Signal | Implication |

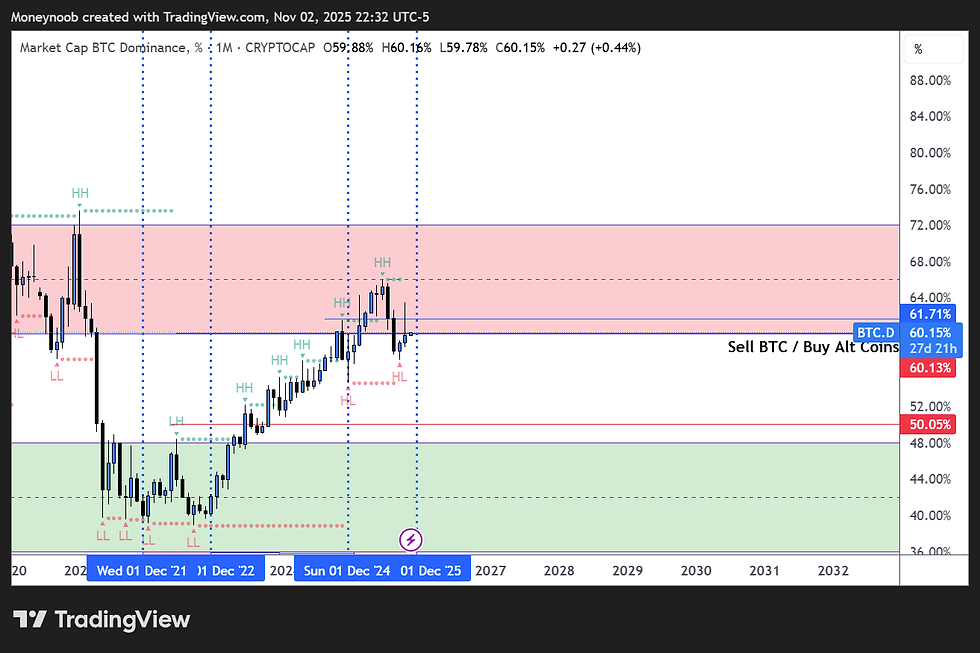

BTC Dominance | Rising | Alts waiting for signal |

ETF Flow | Gradual Inflow | Institutions layering in |

Volatility Index | Compression | Pre-breakout condition |

Retail Interest | Low/moderate | Not in mania phase |

ETH/BTC Ratio | Lagging | Watch for late alt rotation |

🔍 Cycle-Aligned Strategy

Asset | Cycle Role | Action |

BTC | Confidence Anchor | Add on pullbacks, hold above $107K |

ETH | Lagging Multiplier | Begin scaling if ETH/BTC ratio rises |

Alts | Late-phase fuel | Enter only on strong structure + dev score |

🧠 Teaching Focus: Cycle 2 is structure-driven, not sentiment-driven. The market rewards patience with precision.

Closing Insight: This Is the Patience Window

Phase 2 is where real investors get positioned, and real teachers build trust with their learners. Regulation: EU’s MiCA rollout and ongoing SEC debates could inject headline volatility.

“If Phase 1 is for conviction... Phase 2 is for building wealth... And Phase 3 is when everyone wants in — too late.”