September Crypto Snapshot: Volatility, Dominance & Opportunity

- C Dog Lara

- Sep 1, 2025

- 2 min read

Welcome to September — a historically shaky month for crypto, but also one that often sets the stage for year-end rebounds.

Let’s unpack what’s happening with BTC, ETH, and why dominance metrics and institutional flows deserve your attention now.

🚦 BTC & ETH — What’s the Move?

Bitcoin is consolidating near $107K–$108K, down from its $124K high in August. The cause? Profit-taking and macro caution.

Ethereum is in the $4.35K–$4.4K range, down ~6%, yet signs of institutional buying suggest smart money is rotating in.

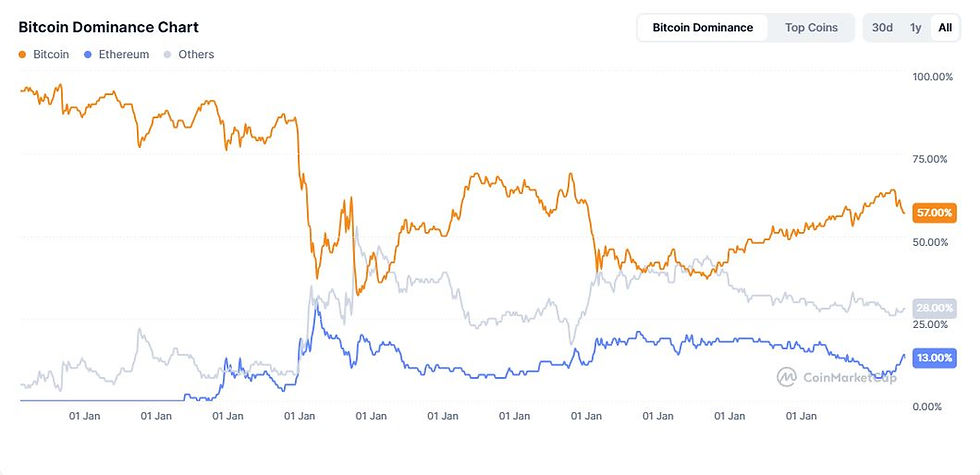

📈 Dominance Check: Market Leadership Signals

BTC Dominance: ~57.8% — slipping from June highs, showing altcoin appetite is returning.

ETH Dominance: ~13.6% — steady rise reflects growing demand for yield and scalability.

👉 When BTC dominance drops and ETH rises, it often means investors are diversifying, not exiting.

⚖️ Correction or Setup?

This isn’t a crash. It’s a healthy market reset:

BTC pulled back 6–10% due to ETF outflows and whales selling.

ETH peaked at $4.96K before dipping—but is backed by $4B in ETF inflows.

🔭 What to Watch in September

Asset | Support | Resistance | Note |

BTC | $109K | $124K | Avg forecast ~$116K |

ETH | $4.16K–$4.35K | $4.58K | Breakout potential |

🔻 September is often a "Red Month", but history shows this can lead to strong Q4 rallies.

🧠 Strategy Snapshot

Theme | Why It Matters |

🔄 Recalibration | Not a crash — it’s a repositioning |

🏦 Institutional Shift | ETH is gaining long-term traction |

📊 Dominance Trends | BTC still leads, but ETH is quietly growing |

📅 Seasonal Setup | September dip → Q4 rebound play |

✅ Final Word

Zoom out. Breathe. September isn’t about panic — it’s about positioning. With ETH gaining traction and dominance shifting, this may be the quiet setup before the storm.

⚖️ 2024 Outlook: Slower, Smarter?

📉 BTC up only ~43% post-halving

🧊 Less hype, more institutional flow

⏳ This cycle may last longer, with lower blow-off tops

As September unfolds, watch not just prices — but where capital is rotating, what dominance levels are signaling, and how institutional behavior is evolving. Stay tuned for the next blog drop.